The average American household has a combined balance of $ 10,000 in control and savings accounts, according to inventory estimates. In recent years, anyone who holds this amount on a high performance account has earned almost 4 % annual interest or about $ 400 a year.

But the average interest rate on the savings account is closer to 0.4 %. All three largest banks of the Nation – Bank of America, Chase and Wells Fargo – offer 0.01 % to their usual savings accounts. This works in $ 1 in interest per year for $ 10,000 deposit.

Banks correspond to these sad percentages with privileges such as many branches and ATMs, but they also know that many of their customers will not hunt for better inactivity offers.

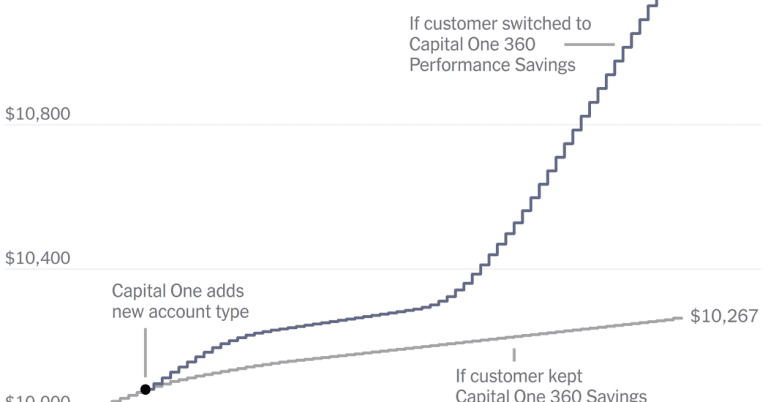

Now, the Financial Consumer Protection Office says that a bank, Capital One, went very far, deliberately confusing customers so that they would not know that they would go to a higher payment account to the same bank. Here’s the difference in what they would have won with interest:

The Consumer Office sued Capital One in mid -January, arguing that the bank was misleading customers, creating a new high performance account called 360 performance savings, leaving an existing account, 360 savings, to weaken at a lower rate. The bank had previously advertised this account as “one of the highest nation’s savings rates”.

The Agency estimates that Capital One avoided paying $ 2 billion, automatically not converting each 360 Savings Bank account into a 360 performance account.

The bank said it disagreed with the characterizations made in the costume of the Consumer Office and would challenge claims in court.

As weak as the savings account 360 compared to the newest account in the same bank, the lowest rate ever reached was 0.3 %, about 30 times higher than the nominal interest rate paid by most large banks.

These banks could hardly pay lower than 0.01 %: the law on saving the truth requires to reveal interest rates to the closest two decimal places, so they cannot name less than 0.01 % without just mentioning 0 %.

Banks know that their customers are generally not careful about account details. A study assigned by Capital One found that many people control their savings account less than once a month and about half do not know what interest they are gaining.

Is customer carelessness illegal? Or just the usual bank’s business?

Christopher Peterson, Professor of Law at the University of Utah, who worked for the Consumer Office in previous cases, said that the specific Capital One claims made in his original 360 savings account, such as the advertising of the account that had a “top savings rate” , may mean the bank is responsible for damage. By 2023 the percentage was lower than the national average and one tenth of the 360 performance account.

A question asked by this case is if Capital One He was obliged to continue to offer a “maximum savings rate” in the original account account in the future. The bank’s advertisement did not report future prices. However, the 2010 Dodd-Frank law, Mr Peterson said, found that “a financial service provider could be held responsible for the inability of consumer inability to understand the products offered to them”.

The Consumer Office claims that the bank ordered branch employees not to provide voluntary information on the new account. And although customers were able to change accounts at any time free of charge, the bank did not email its existing customers for the new account until the organization started.

Many customers probably do not compare their savings account rates with what Federal Reserve does. When the percentage of federal funds decreased in 2020, the Capital One saving 360 decreased with it. But in 2022, when interest rates began to rise again, the saving rates of 360 never approached a high competitive level again. (Performance Saving Account 360 significantly increased its rates.)

This is the first such case that the Consumer Bureau has brought in the days of the Biden administration. Scott Pearson, a lawyer representing banks on regulatory issues, said the organization had “overcome their power” at Capital One’s request.

Mr Pearson noted that banks are not expected to warn customers whenever they are entitled to refinance mortgage. “There is a lot of case law saying that financial institutions do not owe confidential obligations to their clients,” he said. “I don’t know why someone would believe that it is the bank’s job to tell you that you can get a better deal somewhere else or that they will give you a better deal. This is just a shocking and unprecedented theory in my view.”

At present, most of the largest banks have a cloudy advertising on the future, while offering extremely low interest rates. Chase, for example, encourages customers to register for a savings account to “earn interest”, but its standard rate is 0.01 %.

In the last decade, an account that won 0.01 percent annual interest would have earned only $ 10, compared to about $ 2,000 if the same money was maintained in a consistently competitive savings account.

It is not clear whether the legal theory in the Consumer Financial Protection Bureau will be put under test. On Saturday, the director of the organization, Rohit Chopra, was fired by Trump’s administration and a new manager could choose to be less aggressive in pursuing existing claims. Many President Trump’s allies have criticized the bureau, including Elon Musk, who last year stated “CFPB deletion” in social media.