In the stock market, not everything is as it seems.

Slowing inflation has boosted investor confidence in the economy this year and, combined with strong enthusiasm for artificial intelligence, provided the backdrop for a rally that beat expectations.

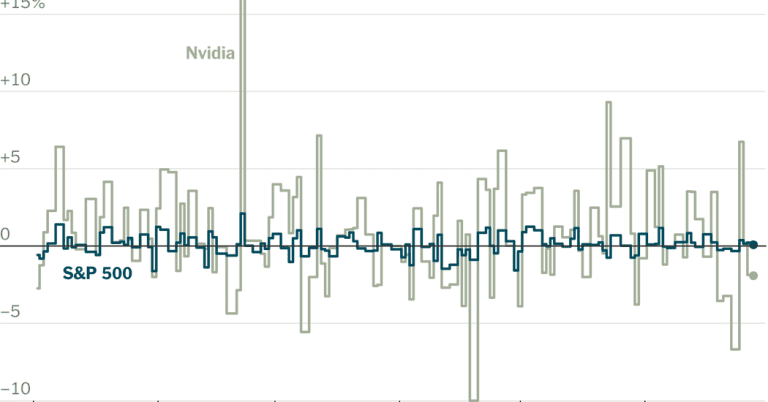

The S&P 500 is up 15 percent in the first half of 2024.

Gains were remarkably consistent, with the index only once rising or falling more than 2 percent in a single day. (It rose.) A widely watched measure of bets for more volatility to come is nearing an all-time low.

But a look beneath the surface reveals much greater turmoil. Nvidia, for example, whose share price surge helped make it the most valuable public company in America last week, is up more than 150 percent this year. The price has it has also taken repeated deep dives over the past six months, shedding billions of dollars in market value each time.

More than 200 companies, or about 40 percent of the index’s stocks, are at least 10 percent below their highest level this year. Nearly 300 companies, or about 60 percent of the index, are more than 10 percent above their low for the year. And each group includes 65 companies that have moved in both directions.

Traders say this lack of correlated movement – known as dispersion – between individual stocks is at historic highs, undermining the idea that markets have settled in.

One measure of this, an index from stock market operator Cboe Global Markets, shows that dispersion has widened since the coronavirus pandemic, as tech stocks soared while shares of other companies suffered. It remained high, in part because of the stunning appreciation of a select few stocks on the cutting edge of artificial intelligence, analysts say.

That presents an opportunity for Wall Street as investment funds and trading desks pile into spread trading, a strategy that typically uses derivatives to bet that index volatility will remain low while volatility in individual stocks remains high.

“It’s all over the place,” said Stephen Crewe, a longtime spread trader and partner at Fulcrum Asset Management. He believes these dynamics have surpassed even the most highly anticipated economic data in terms of their importance to financial markets. “It hardly matters for GDP or inflation data right now,” he added.

The risk for investors is that stocks will start moving in the same direction again, all at once – possibly due to a spark that ignites widespread selling. When this happens, some fear that the role of complex volatility trades could reverse and, rather than mitigate the occurrence of turbulence, exacerbate it.

Dispersal trade.

Estimating the total size of this type of trade is challenging even for those embedded in the market, in part because there are many ways to make such a bet. Even in its most basic form, spread trading can involve many different financial products being bought and sold for many other reasons as well.

How big is it; “That’s a million-dollar question,” Mr Crewe said.

But there are some indications. The options market has exploded — the number of contracts traded is set to top 12 billion this year, according to the Cboe, up from 7.5 billion in 2020 — and while there have always been specialists with unusual derivatives strategies, more mainstream fund managers are now called to accumulate.

Assets in mutual funds and exchange-traded funds that trade options, including spread trading, rose to more than $80 billion this year, from about $20 billion at the end of 2019, according to Morningstar Direct. And bankers who offer clients a way to replicate sophisticated trades, but without the expertise, say they’ve seen a lot of interest in spread trading.

However, while its extent cannot be fully known, this perceived influx of capital has raised comparisons with the last time volatility trading became popular, in the years before 2018.

Back then, investors were crammed into options and leveraged exchange-traded products that had big returns in down markets but were highly susceptible to sharp sales that increase volatility. These trades were expressly “low volatility”, meaning they profited when volatility dropped, but lost heavily when the market got choppy.

So when calm markets suddenly erupted and the S&P 500 fell 4.1 percent in one day in February 2018, some funds disappeared.

While this dynamic remains, analysts say it is much less important and the emergence of popular diversification strategies is fundamentally different.

Because the trade seeks to profit from the difference between the low volatility of the index and the large swings in individual stocks, even in a violent selloff the result is usually more balanced, with one part likely to rise in value while the other to decrease.

But even this generalization depends on how the trade was executed, and there are circumstances that could cause problems for investors. This potential outcome is part of the reason why dispersal negotiations are attracting so much attention right now—everything could go well, but it’s very hard to know for sure, and what if it doesn’t?

“Firewood is very, very dry,” said Matt Smith, fund manager at London-based asset manager Ruffer. “And there’s a lot going on in the world, so the weather is hot.”

Relaxation can be ugly.

Most importantly, the largest companies in the market are also dispersed. Microsoft, which is benefiting from artificial intelligence excitement, is up 20 percent this year. Tesla is down 20 percent. Nvidia remains the outlier, with impressive profits.

So even on a day like Monday, when Nvidia fell 6.7%, the S&P 500 only fell 0.3%. The broad index was supported by other stocks, especially other mammoth tech companies like Microsoft and Alphabet.

Calm appeared to prevail, despite a sharp drop in one of the index’s biggest components.

When all the very large stocks start falling en masse, as they did in 2022, the result could be painful. Scatter trading could make it all worse.

If S&P 500 volatility is jolted higher because a stock like Nvidia falls, but the damage is limited to specific technology or artificial intelligence sectors, a lopsided outcome would punish many spread trades, according to industry experts. Losses could mount as traders looking to cut their losses take trades that exacerbate volatility.

This possibility is hypothetical. Nvidia has yet to satisfy demand for its chips, and its profits continue to soar. The spread could continue for some time given this unusual market momentum, bankers and traders said.

However, for some expert investors more experienced with the intricacies of spread trading, trading has lost its luster as it has been pushed to ever more extreme levels.

Naren Karanam, one of the market’s biggest spread traders, who trades at hedge fund Millennium Partners, has reduced his activity, seeing fewer opportunities for profit, people familiar with his decision said. A rival hedge fund, Citadel, lost its head of diversification in January and chose not to replace the person.

Even some who remain in the market say the extreme current momentum, with index-level volatility so low and individual stock dispersion so high, leaves them with little appetite to increase their trades. Others have begun to take the opposite side of the trade, hedging themselves against a turbulent sell-off.

“The spread can’t go much higher and the volatility can’t go much lower,” said Henry Schwartz, global head of client engagement at Cboe. “There is a limit.”