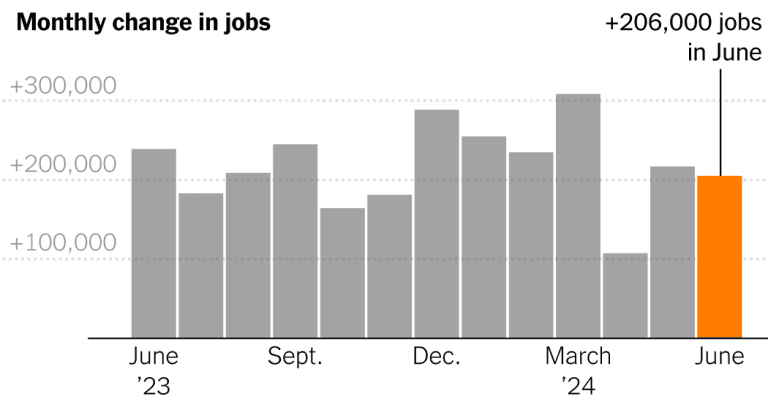

The labor market has maintained surprising strength over the past year, but as fewer jobs remain unfilled and a growing number of people remain on unemployment insurance rolls, Federal Reserve officials have begun to watch for cracks.

Central bankers have recently begun to make clear that if the labor market softens unexpectedly, they could cut interest rates — a slight shift in their stance after years of working to cool the economy and bring the red-hot labor market back into balance. .

Policymakers have left interest rates at 5.3 percent from July 2023, a decades-high that makes it more expensive to get a mortgage or carry a credit card balance. This policy-making slowly burdens demand across the economy, with the goal of fully combating hyperinflation.

But as inflation falls, Fed officials have made clear they are trying to strike a careful balance: They want to make sure inflation is under control, but they want to avoid upsetting the labor market. Given that, policymakers have signaled in the past month that they would react to a sudden weakening of the labor market by lowering borrowing costs.

The Fed would like to see more inflation data “like what we’ve seen recently” before cutting interest rates, Fed Chairman Jerome H. Powell said during a speech this week. “We would also like to see the labor market remain strong. We said that if we saw the labor market weaken unexpectedly, that’s also something that could require a response.”

That’s why employment reports are likely to be a key benchmark for central bankers and Wall Street investors looking to see what the Fed will do next.

For years, the Fed has been watching the labor market for a different reason.

Officials worried that if labor market conditions remained too tight for too long, with employers struggling to hire and paying ever-increasing wages to attract workers, it could help keep inflation running faster than usual. That’s because companies with higher labor costs will likely charge more to protect profits, and workers who earn more will likely spend more, fueling continued demand.

However, recently, jobs have declined and wage growth has slowed, signaling that the labor market is cooling off the boil. This caught the attention of the Fed.

“At this point, we have a good labor market, but not a bubble,” Mary C. Daly, president of the Federal Reserve Bank of San Francisco, said in a recent speech. “Future labor market slowdown could translate into higher unemployment as businesses need to adjust not just job vacancies but actual jobs.”

The unemployment rate has risen slightly this year, and officials are watching closely for a sharper move. Research shows that a sudden and marked rise in unemployment is a sign of a recession – a rule of thumb set out by economist Claudia Sahm and often referred to as the ‘Sahm Rule’.