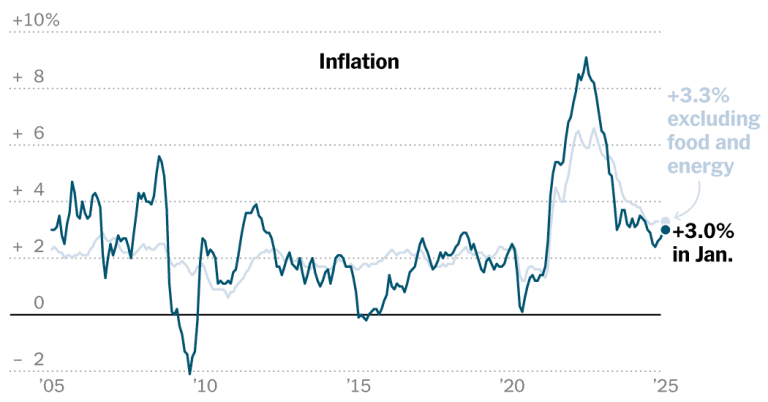

US inflation increased to 3 % in January, boosting the case for the Federal Reserve to expand a cessation of interest rate cuts.

Consumer Price Index increased more than expected, data from the Work Statistics Office showed Wednesday, increasing 0.5 % since December what was the fastest monthly increase since August 2023. Last month the annual rate was 2 , 9 %.

The CPI “Core”, which more reflects underlying inflation by removing volatile food and energy prices, also showed a little improvement. It increased by 0.4 % since December or 3.3 % on an annual basis, the higher than the economists were expected. The monthly increase in basic prices was the highest than April 2023.

The January data underlined the heterogeneous nature of the central bank’s battle against high prices. Inflation has drastically receded from lifting just over 9 % in 2022, but progress in recent months has been much more sporadic.

Last month, price increases in areas closely monitored by consumers – from grocery to gasoline – offset reductions in other categories such as clothes and furniture.

Grocery prices rose 0.5 % compared to the previous month or 1.9 % on a yearly basis. This has been largely led by a national lack of eggs caused by an outburst of bird flu or bird flu, which prompted prices up 15.2 % in the last four weeks. Since last year, egg prices rose by 53 %. It was the largest monthly increase in egg prices since June 2015, representing about two -thirds of the total grocery prices since December.

Gasoline prices also increased by 1.8 % during the month, although they decreased by 0.2 % compared to the same time last year. Among other categories to increase airline fares and hotel prices. Used cars and trucks as well as car insurance have increased, up to about 2 % since December.

Economists watched closely for further housing cost improvements, a slowdown that began to appear in the late last year. This progress made in January, with shelters rising by 0.4 % during the month or 4.4 % on a yearly basis.

Price pressures insist on a period of extreme uncertainty about the prospects for the economy just weeks in President Trump’s second term in the White House. Invoices, deportations, tax cuts and liberalization are expected to have a financial impact, but the final combination of policy will determine whether economists and policy makers will give the risk of rejuvenating inflation or an unexpected development.

The Republicans rushed to blame Biden’s administration. Spokesman Jason Smith Missouri, who is head of the House and Means committee, said the former president “failed to reduce prices and left behind a chaos of inflation that President Trump cleans”.

In a publication of social media after the release of the report, Mr Trump himself said: “Biden Inflation!” This was followed by another mission earlier on the day, in which he called to reduce interest rates, saying it was “something that would happen to the upcoming invoices!”

But the Fed has marked the lowest percentages at present, creating a possible conflict with a president who showed in his first term to criticize the central bank when he resisted his demands for cuts. After a percentage of cuts in the cuts in the last three months of last year, rates now hover between 4.25 % and 4.5 %.

Speaking to legislators this week as part of two days of listening, Fed Jerome H. Powell President confirmed that a stable labor market meant that the central bank did not have to be “in a hurry” to reduce rates. On the contrary, he said, the Fed was “well positioned to face the dangers and uncertainties we face”.

Officials have suggested that as long as the labor market remains stable, they should see more substantial progress in inflation that is reduced before taking into account their policy.

John Williams, president of New York’s Federal Reserve Bank, said in a speech on Tuesday that he is expecting progress for the 2 % inflation goal, although he noted that “it will take time before we can achieve this goal in a prolonged base.”

Following inflation report, merchants in federal markets for future capitalization reduce their bets on when the Fed will reduce lower interest rates, pushing back the timetable from September to December. The worst of our expected data sent stocks and government bonds.