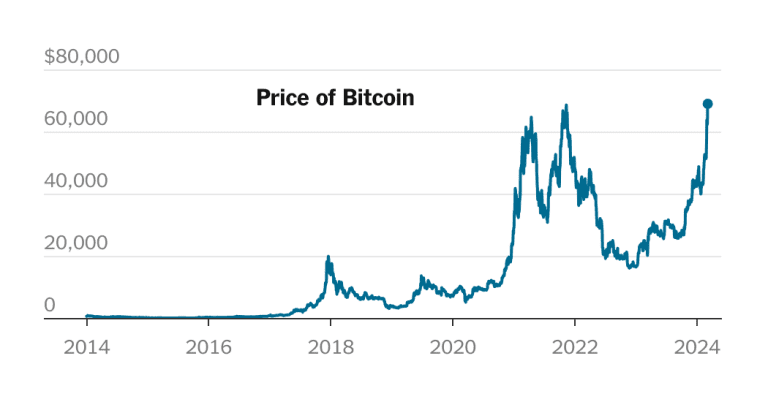

Bitcoin hit a record high of more than $69,000 on Tuesday, capping a remarkable comeback for the volatile cryptocurrency after its value plunged in 2022 amid a market crash.

Bitcoin’s price has risen more than 300 percent since November 2022, a resurgence that few predicted when the price fell below $20,000 that year. Its previous record was just below $68,790 in November 2021 as cryptocurrency markets boomed and amateur investors cashed in on experimental digital currencies.

The cryptocurrency has been “declared dead for the 150th time,” said Cory Klippsten, CEO of Swan, a financial services firm focused on Bitcoin. “And Bitcoin continues to do what Bitcoin does, which is win people over as they take the time to really learn about it.”

Bitcoin’s recent rise is driven by investor excitement for a new financial product linked to the digital currency. In January, US regulators authorized a group of crypto companies and traditional financial firms to offer exchange-traded funds, or ETFs, that track the price of Bitcoin. Funds provide a simple way for people to invest in the crypto markets without owning the virtual currency directly.

As of last week, investors had poured more than $7 billion into the investment products, fueling Bitcoin’s rapid rise, according to Bloomberg Intelligence.

The price of Ether, the second most valuable digital currency after Bitcoin, has also risen more than 50 percent this year, reaching around $3,800. Its rise is due in part to excitement over the prospect that regulators may also approve an Ether-linked ETF.

But cryptocurrencies remain volatile. Within minutes of the record, the price of Bitcoin fell to around $67,500.

And despite the euphoria, the crypto industry is still navigating the legal ramifications of the 2022 crash. Sam Bankman-Fried, the disgraced founder of the doomed crypto exchange FTX, is set to be sentenced to prison later this month. The Securities and Exchange Commission has sued several prominent crypto companies, including US exchange Coinbase, alleging that the companies are offering unregistered securities.

Courts have begun hearing some of these lawsuits, and the outcome could determine whether crypto companies can continue to operate in the United States. Many skeptics remain convinced that digital currencies offer much utility in the real world.

“There is no intrinsic value,” said John Reed Stark, a former SEC official and outspoken critic of the crypto industry. “There is no proven track record of adoption or trust.”

Bitcoin was invented in the wake of the 2008 financial crisis by a mysterious programmer who goes by the pseudonym Satoshi Nakamoto. Digital currency was originally envisioned as a decentralized alternative to the traditional financial system, a way for people to exchange funds without relying on banks or other intermediaries.

But as the value of Bitcoin increased, it became a vehicle for financial speculation. The currency’s price rose quickly, before falling just as quickly — making new millionaires one day and wiping out their savings the next.

At the start of the pandemic, an increase in day trading by amateur investors helped turn cryptocurrencies into a hot commodity. The industry was featured in explosive magazine spreads and Super Bowl ads, sending Bitcoin’s price soaring.

Within a year, the bubble burst. A series of corporate implosions culminated in November 2022 with the collapse of FTX, Mr. Bankman-Fried’s stock exchange. Investors lost billions of dollars as the price of Bitcoin plummeted to around $16,000.

The industry’s fortunes began to improve in August, when a federal appeals court cleared the way for companies to offer Bitcoin-linked ETFs. An ETF is essentially a basket of assets divided into stocks. Investors buy shares in the basket, rather than owning the assets directly.

In the cryptocurrency world, this means investors can gain exposure to Bitcoin without mastering the technicalities of a digital currency wallet or entrusting large sums of money to fly-by-night companies with checkered legal histories. Financial giants like BlackRock and Fidelity offer Bitcoin investment products, providing a measure of stability in a volatile industry.

For years, cryptocurrency advocates have predicted that the approval of Bitcoin ETFs would bring billions of dollars in new investment to the industry, though some analysts have expressed skepticism about those predictions.

Early evidence suggests the impact has been significant. In recent months, the approval of investment vehicles has combined with other factors to drive up the price of Bitcoin.

“Every time you’re in despair, it looks like cryptocurrencies and Bitcoin are never going to come back,” said John Todaro, an analyst at Needham who follows the crypto industry. “But we’ve seen time and time again that it continues to move forward.”

Later this year, the amount of new Bitcoin put into circulation will decrease due to an event known as the “halving.” The event, which was programmed into Bitcoin’s underlying code, will halve the amount of Bitcoin people receive when they run software to validate crypto transactions (a process commonly known as “mining”).

The prospect of Bitcoin’s supply scarcity has helped drive its price higher this year, some analysts argue. And with the halving expected to take place in the spring, Bitcoin supporters predict prices will continue to rise.

“This is just the beginning of this bull market,” said Nathan McCauley, CEO of crypto firm Anchorage Digital, as prices soared this month. “The best are yet to come.”