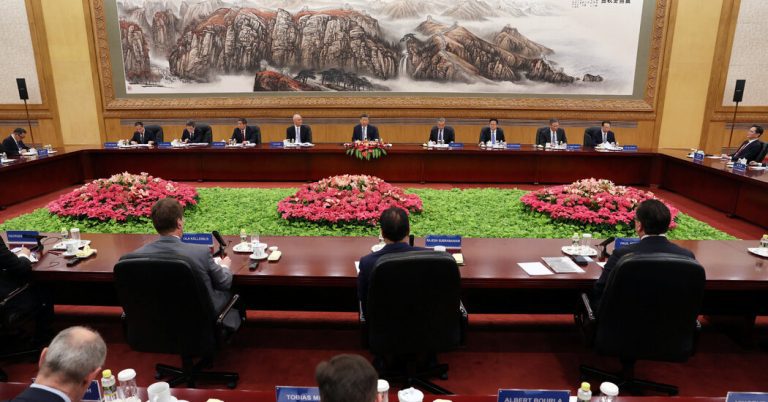

Xi Jinping, a leading leader in China, met with executives of Saudi Aramco, BMW, Toyota Motor, FedEx and dozens of other foreign companies in the large people’s hall in Beijing on Friday, as China seeks to boost foreign investment in the midst of worse relations between the United States.

It was the third time that Mr Xi has met with multinational executives in the last 17 months, with investment, as the slow growth and strengthening of national security laws have made global companies cautious to carry out large data in China.

New foreign investment in China has declined significantly in recent years. One exception is the German automotive industry, which sees China, the largest car market in the world, as a place to try to compete with more and more terrible domestic automakers.

German automakers represented half of the new investment from the European Union last year, according to Rhodium Group, a consulting company. BMW has increased its share in a Chinese consortium and this week has announced that it will use the artificial intelligence technology developed with the Chinese technological giant Alibaba in his assistant in the car.

A huge new Volkswagen power plant in central China was one of the few new production facilities manufactured by foreign businesses in China last year. Volkswagen also bought a small share in a Chinese automaker, Xpeng, as part of an approach describing as “in China, for China”.

The meeting with Mr. Xi came four days after the China Development Forum, an annual financial and economic event that participated in world executives. Apple’s Tim Cook, Stephen Schwarzman of the Blackstone Group and Astrazeneca, Cargill, Pfizer and FedEx, were in Beijing to watch the forum along with the presidents of dozens of Chinese companies.

Speaking to the forum, Ola Källenius, Mercedes-Benz’s chief executive, talked about how his company had invested in Chinese engineering, including $ 2 billion spent in China in a long-wheel electric car.

Oliver Zipse, BMW’s chief executive, said Germany had not invested only $ 16 billion since 2010 in its senyang activities in northeast China, but also had objected to the European Union in invoices for cars exported from China to Europe.

China destroyed foreign $ 116 billion in foreign investments last year, from $ 163 billion last year and the top of $ 189 billion in 2022, according to the China Ministry of Commerce. Many of this money comes from reinvesting profits by existing businesses.

Tensions between Washington and Beijing have discouraged US companies to make new investments.

Continuously sealing laws on national security discourage some investors. Five Chinese employees of the Mintz Group, a US Corporate Counseling company, were released after two years of detention, the company said this week. Businesses such as the Mintz Group, which do research or due diligence for companies, have been mostly removed from China, leaving multinationals without the support they need to check if possible investment will face legal, environmental or political issues.

Another problem for foreign businesses in China, according to foreign trade chambers surveys, is the deterioration of the domestic market. Many industries suffer from severe over -consumption and reduced prices. The ability to gain profit from new investment is limited.

Siyi zhao and Berry wang He contributed research.