The US economy continues to throw curves and the May jobs report is the latest example.

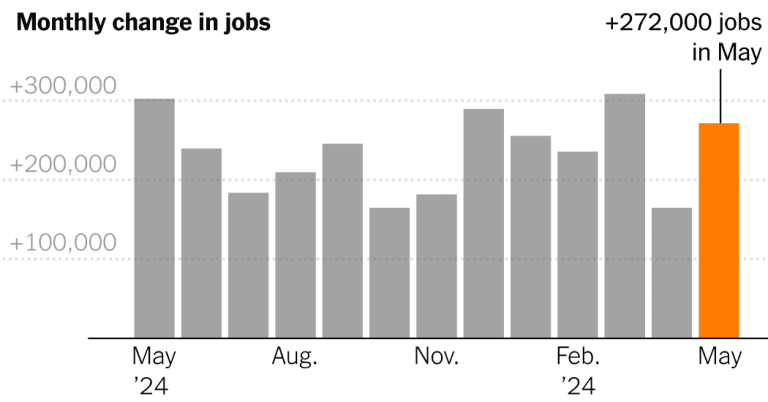

Employers added 272,000 jobs last month, the Labor Department said on Friday, well above what economists had expected as hiring had gradually slowed. That’s up from an average of 232,000 jobs over the previous 12 months, muddling the picture of an economy easing to a more sustainable pace.

More worryingly for the Federal Reserve, which meets next week and again in July, wages rose 4.1 percent from a year ago – a sign that inflation may not yet be beaten.

“For those who might have thought they would see a rate cut in July, that door has largely closed,” said Beth Ann Bovino, chief U.S. economist for US Bank. While wage increases are good for workers, he noted, persistent price increases undermine their spending power.

Stocks fell shortly after the report was released, then recovered most of their losses by the end of the day. Treasury yields, which track expectations for Fed interest rate moves, rose sharply and remained high during the trading day.

But the portrait of an accelerating labor market is not entirely clear either. Elsewhere in the report, the unemployment rate rose to 4%, the highest point since January 2022. That figure comes from a survey of households, which showed virtually no growth in employment last year and an increase in part-time work that had displace full-time jobs.

Data from employers that generate the employment growth number tend to be more reliable, but the household survey has recently been more consistent with other indicators. Retail sales have flattened. Gross Domestic Product fell sharply in the first quarter. The number of jobs is as low as it has been since 2021.

That’s why most economists expected employment growth to continue to slow and the unemployment rate to rise further this year.

“Outside of healthcare, we don’t see as much strength in data,” said Parul Jain, chief investment strategist at MacroFin Analytics. “Growth in 2024 is unlikely to be very strong, consumers are pulling back quite a bit and we expect disposable income to be affected as well.”

Health care has been the backbone of hiring for two and a half years, providing 18.6 percent of added jobs. An aging population has driven demand, and increasing insurance coverage through the Affordable Care Act has given more people access to care.

On the other hand, leisure and hospitality – hit harder than any other sector by the Covid-19 lockdowns – took until April to recover to February 2020 employment levels. Forecasts for a record summer travel season may push that number higher in the coming months, although few expect employment growth to surpass last year’s numbers.

United Airlines, for example, said this week it expects to add 10,000 jobs this year, up from 16,000 in 2023 and 15,000 last year, as recovery from the pandemic shifts to organic growth.

One reason the job growth beat forecasts was government employment, which rebounded quickly but was expected to slide as federal funding for pandemic relief ends. By contrast, the industry added 43,000 jobs in May. But a slowdown may still be on the horizon.

It’s already apparent to Peter Finch, the superintendent of the West Valley School District, which is outside Yakima, Wash. Funding in the American Rescue Plan Act allowed it to add staff members such as mental health counselors and teachers, but it is now short of filling positions as people leave.

“It’s a difficult time in education,” Dr Finch said. “If you have fewer resources, you can’t provide the same services you did in the past — that’s the reality.”

The labor market’s impressive run was fueled by both a recovery in legal immigration and an influx of millions of temporary status immigrants, many of whom found work with the help of expedited work permits. According to calculations by the WE Upjohn Institute for Employment Research, hiring plummeted for native-born workers but held up for those born outside the country.

That impact may also fade as President Biden’s executive order restricting asylum seekers at the southern border takes effect.

A favorable sign for the workforce: The percentage of 25- to 54-year-olds working or looking for work reached its highest level since early 2002, at 83.6 percent. Women in this age group have led the way and in May reached the highest participation rate on record.

The picture is not so rosy for adults in their early 20s, whose participation rate fell in May. As employers retain workers and fewer leave voluntarily, there is less room for those with little work experience, who find work at lower rates.

Workers over 55 also haven’t returned to the workforce in large numbers — their participation rate remains two full percentage points below where it was before the pandemic. But some people have been pushed out as costs have risen and pension funds have been unable to cover them.

Take John Refoy, 67, who retired from the Navy after 33 years as a maintenance technician. He moved to Flagstaff, Ariz., to be closer to his sister during the pandemic. As the cost of rent and food rose — and a Subaru Outback cost more than he expected — Social Security and a civil servant pension no longer paid the bills. So, late last year, he applied for a job at Walmart.

Working full-time in the bakery and deli department — a job that now pays $20 an hour, after years of pay raises — has doubled his income.

“It makes all the difference,” Mr Refoy said. He’ll probably quit his job next year when the car is paid off, he said, but he enjoys the social interaction. “It’s a great group of people,” he added, “and it’s been really beneficial for me to get back out there to work.”

Mr. Biden chose to focus on the jobs side of the report. “In my view, 15.6 million more Americans have the dignity and respect that comes with a job,” he said in a news release. But in a nod to deep concerns about persistent inflation, Mr. Biden also highlighted his efforts to lower prices.

The path of the labor market heading into the fall has profound implications for the upcoming election. And while most forecasters see growth weakening, the likelihood of an outright recession is as low as it has been in several years, barring an external event like an escalation of wars or an unforeseen financial crisis.

“We could be right where we’d like to be in a stable equilibrium,” said Brad Hershbein, associate director of research at the Upjohn Institute, “where things are mostly bearish, inflation continues to fall, labor market is coming back to a place where we would expect 150,000 to 175,000 jobs a month.”