President Trump has promised to create a time of American exemption with policies that first set the United States and in front of other nations.

But Mr Trump’s moves in the early days of his administration had the opposite effect for the US stock market.

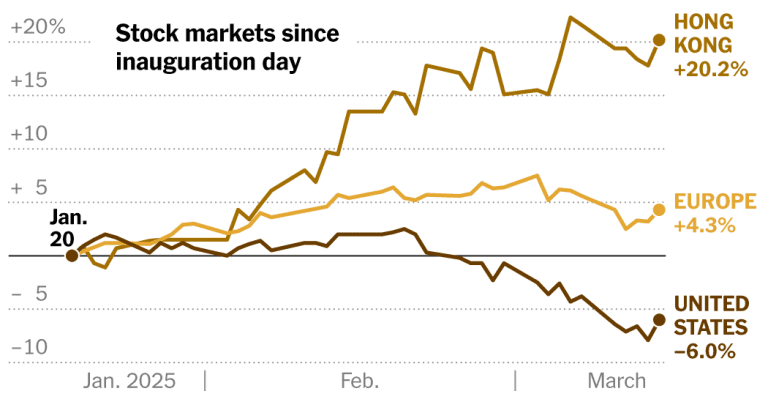

The S&P 500, which for years had passed over the shares of other countries, is now following the major markets of Europe and China, as investors have begun to draw money from the United States and rewriting it around the world.

From the inauguration of Mr Trump, the S&P 500 decreased by 6 %, while the DAX index in Germany increased by 10 %and the Stoxx 600 index across Europe has earned more than 4 %. Other US indicators have even worse, as European markets have been reinforced by plans for military spending on Epirus, as Mr Trump has made it clear that they want these nations to do more to protect themselves.

The Hang Seng Index in Hong Kong has increased further, increasing more than 20 percent since Mr Trump assumed duties in January, led by the Chinese government’s efforts to stimulate his economy. The Mexican IPC index, which focuses on the domestic fire and proves to be resistant to Mr Trump’s abrupt invoices, is 5 percent higher.

With US markets being plagued by the uncertainties about Mr Trump’s pricing policies and deep cuts in the federal government, investment councilors began directing customers to other stock markets around the world.

“It’s definitely time to look at the former US,” said Jitania Kandhari, deputy chief investment official of the Morgan Stanley Investment Management. He said he had noticed an increase in talks with clients who wish to increase their exposure to international stocks.

Even the global markets that have fallen have managed to exceed the S&P 500. The FTSE All-World index has fallen by 2.9 % from the inauguration, weighed in stocks entering the US. Canada’s TSX index decreased by 2 %. And the Japanese Nikkei 225 has decreased by 3.6 %.

In recent weeks, Wall Street has sent a series of research bank notes, customer presentations and commercial ideas that constitute an axis away from the United States.

“Respect the durability, fade our exception and concern about politics,” read the title of one of these presentations by Bruce Kasman, the lead economist and the worldwide leader of JP Morgan.

Brad Rutan, a market general at the MFS Investment Management, said he also saw opportunities outside the United States. “It is safe to say that there is enough space now for international shares.”

Last week, investors pulled money from funds buying US reserves for the first time this year, according to weekly data lasting Wednesday from EPFR Global. The withdrawal amounted to a moderate $ 2.5 billion, compared to the influx of about $ 100 billion in the first nine weeks of 2025.

While some traders are extremely fast to react to new information on the market, others, especially those who expect to be invested for a long time, such as pension funds or university containers, may take months to move their money around.

“After such a prolonged US overdose over Europe, these things cannot turn 180 degrees into a month,” said Greg Boutle, head of the US stock and the strategic derivatives in BNP Paribas. “There are probably many investors who have not yet been rebuilt.”

If investors continue to pull their money out of US reserves and invest in foreign markets, it could add to the sales pressure last week dragged the S&P 500 to correction, which is set more than 10 % from its top.

US markets are so great that the complete exit from foreign investors is almost impossible, Ms Kandhari said: “But shift can surely create market moves.”

The recent retirement comes after years, when the US brokerage market was the envy of the world, attracting foreign investors looking for higher yields than their domestic markets could offer.

About $ 420 billion was introduced in funds that buy US reserves in 2024, according to EPFR Global data, helping to raise large higher indicators and contributing to the development of a handful of large technology companies. About two-thirds of the valuation of the FTSE all-world index come from US reserves, with nine of the top 10 stocks in size from the United States.

During the year that led to the presidential election, the S&P 500 exceeded many of the other indicators around the world, increasing 32 %. The next best was Germany’s DAX, increased 27 %.

Many investors are still elevated in US reserves in the long run and believe that they will again overcome foreign stocks.

Europe can increase government spending, possibly promoting growth. But this explosion could be driven by the fear of war, not because of the sustainable economic power. And if the United States is entering an economic downturn, the rest of the world is unlikely to be saved by the fall.

“I think all this uncertainty is finally settled down and will continue to stay with the US that has the advantages of Europe and other countries,” said Paul Christopher, head of the World Market Strategy at the Wells Fargo Institute of Investment Institute.

Other investors are wondering if the current moment could be the beginning of a turning point, raising the long -term trend of US exemption in financial markets.

“I think this discussion is happening,” Ms Kandhari said.