Tesla’s shareholder vote on Elon Musk’s pay is in some ways a referendum on the performance of the company and its CEO.

But even before the vote is completed on Thursday, Tesla’s share price shows that investors have plenty of doubts about Mr. Musk and the automaker’s prospects.

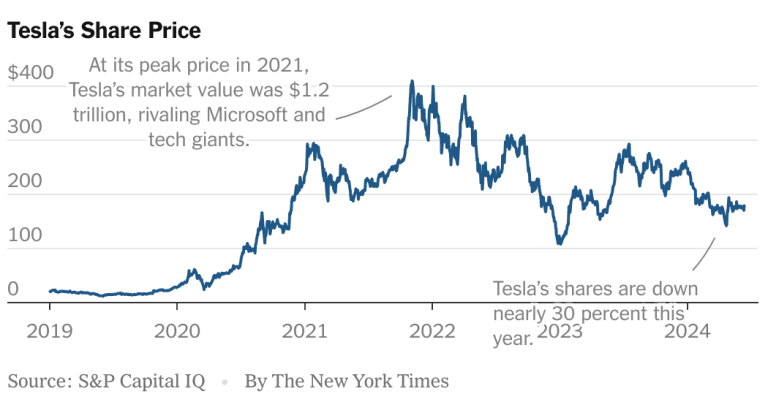

Tesla shares are down nearly 30 percent this year, even as the broader stock market is up 14 percent. At its peak in 2021, Tesla’s market value was $1.2 trillion, putting it in the company of tech giants like Microsoft, Apple and Google. Its value has since sunk to about $576 billion, ranking it alongside less-racist companies like Visa and Walmart.

Blame concerns about Tesla’s business.

The company is facing tougher competition and although its flagship models have sold extremely well, demand for them seems to be waning. Price cuts aimed at boosting interest are eating into profit margins. And analysts say there are no new models coming soon that could spark another buying wave.

“They’ve really struggled to grow,” said Toni Sacconaghi, an equity analyst at Bernstein who covers Tesla. “And part of the reason they’ve struggled to grow is that they don’t have new models.”

Tesla’s first-quarter profit fell 55% to $1.1 billion from a year earlier, while revenue fell 9% to $21.3 billion. The company revealed plans to lay off 10 percent of its workforce, or 14,000 people.

Investors may also be avoiding Tesla stock because they believe it is overvalued. It’s priced at about 50 times the earnings per share that analysts expect Tesla to generate next year. The broader stock market trades at a much lower multiple — 20 times.

However, some analysts still recommend buying the stock because they expect Tesla’s growth to return when a lower-cost electric vehicle is finally released. “They still have significant volume growth ahead of them,” said Garrett Nelson, who covers Tesla for CFRA.

Mr. Nelson said he also expected Tesla to earn more from selling software designed to help Tesla owners drive their cars. And some on Wall Street hope Tesla will one day follow through on its plan to build a massive fleet of self-driving taxis. Ark Invest, an investment firm led by Cathie Wood, a longtime Tesla fan, believes the so-called robotaxis could lift Tesla shares to $2,600, nearly 15 times their current value.

Tesla’s current slump is quite different from the sharp uptrend that sent its stock on a meteoric rally and allowed Mr. Musk to win all the stock options in the award that are up for vote.

Shareholders approved the compensation package in 2018, but a Delaware judge struck it down in January on the grounds, among other things, that Mr. Musk had effectively overseen his own compensation plan. Tesla is hoping that if shareholders back the package again, the court will reinstate it. Some big investors say they will vote against the pay deal, currently worth about $45 billion, because it is too big.

The drop in Tesla shares points to a flaw in pay packages based on stock price performance: Executives usually don’t have to pay back the pay if the stock falls below the price at which they earned it.

Tesla’s stock market value is now at a level that would have failed to qualify Mr Musk for part of the package. But he can keep it because the market value has achieved the targets within the time specified in the package.

Mr. Musk’s actions may also weigh on Tesla’s stock.

In 2021 and 2022, he sold about $38 billion of Tesla stock to help finance the acquisition of Twitter, now called X. His stake in Tesla, once about 30 percent, is now 13 percent without his shares package of 2018 and 20 percent With it.

Mr Musk said he would like a 25% stake. “It’s not so much that I can control the company even if I go crazy,” he said in January. “But it is enough that I have a strong influence.”

Mr. Musk and Tesla’s press department did not respond to a request for comment.

A pressing question is whether Tesla’s stock could fall if Mr. Musk loses the vote on the pay package. Investors may sell if they believe he is critical to the company’s future. But with much of his wealth in Tesla, Mr. Musk may see little reason to walk away.

Mr. Sacconaghi asked him on an investor call in April if he was considering reducing his stake in Tesla. “I have to make sure that Tesla is very prosperous,” Mr. Musk said.