Move over, Microsoft and Apple. The stock market has a new king.

On Tuesday, Nvidia overtook two of tech’s biggest names to become the world’s most valuable public company, according to data from S&P Global. Its rise has been fueled by the boom in genetic artificial intelligence and growing demand for the company’s chips — known as graphics processing units, or GPUs — that make AI systems possible.

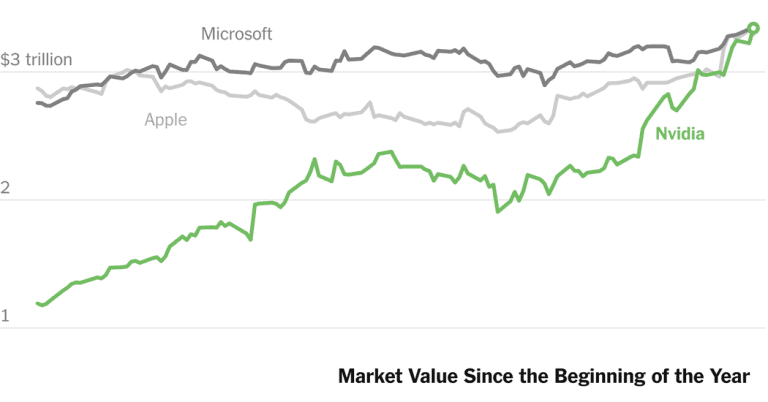

Nvidia’s rise is one of the fastest in market history. Just two years ago, the company’s market valuation was just over $400 billion. Now, in the space of a year, it has gone from $1 trillion to more than $3 trillion.

On Tuesday, Nvidia’s stock price rose 3.6%, raising its value to $3.34 trillion. Microsoft and Apple both fell, ending the day behind the Silicon Valley chipmaker.

Nvidia’s rise is a testament to how much artificial intelligence has disrupted the world’s biggest companies. The rise of the tech powerhouse propelled Microsoft to the largest market capitalization for the first time in January, dethroning Apple, before pushing Nvidia to take the crown. Last week, Apple also said it was getting into the AI game and would add the technology to its products, including the iPhone, this fall.

Years before other major chip companies, Nvidia CEO Jensen Huang bet that GPUs would be essential to building artificial intelligence and adjusted his company to accommodate what he believed would be the next big boom in technology.

His big bet is paying off. By some measures, Nvidia controls more than 80 percent of the market for chips used in AI systems. Nvidia’s biggest customers regularly take orders for chips to run computers in their giant data centers and build their own AI chips so they are not so dependent on one supplier.

“No one else saw or fully appreciated this,” said Daniel Newman, chief executive of the Futurum Group, a technology research firm. “They saw the trend, built for the trend and enabled the market. They can effectively charge whatever they want.”

The rise of Nvidia has made Mr. Huang, 61, a celebrity in the tech world. After a computer conference in Taiwan earlier this month, he was surrounded by attendees who wanted his autograph, including a woman who asked him to sign her breast.

The company’s rise is reminiscent of dot-com-era titans like Cisco and Juniper Networks, which built the equipment that ran communications networks for the Internet. Cisco stock rose more than a thousand between its initial public offering in 1990 to 2000, when it briefly became the world’s most valuable company.

The speed at which Nvidia’s value has risen has been astonishing. Apple surpassed $1 trillion in August 2018 and became the first company valued at $3 trillion last June. It also took Microsoft nearly five years to go from $1 trillion to $3 trillion.

Nvidia’s investors are betting more on its potential than its current earnings. Microsoft and Apple each made more than $21 billion in profits during the three months ending in March. Nvidia posted a profit of $14.88 billion in the most recent quarter, which ended in April, but that was more than 600 percent higher than last year.

“The numbers have gotten so big so fast that people are worried: Is this sustainable?” said Stacy Rasgon, an analyst at Bernstein Research. “If it turns out that there is no return to artificial intelligence, then the whole thing falls apart.”

Just 12 companies have led the S&P 500 by market capitalization since the index’s inception in 1926: AT&T, Apple, Cisco, DuPont, Exxon Mobil, General Electric, General Motors, IBM, Microsoft, Philip Morris, Walmart and now Nvidia, according to S&P Dow Jones Indices.

Nvidia’s rise has been fueled by its ability to consistently beat Wall Street expectations. Sales in the latest quarter tripled from a year earlier to $26 billion. It also predicted that it will double sales in the current quarter.

Nvidia sells everything from chips and the software needed to build AI systems with those chips to supercomputers. The machines, which have 35,000 parts and are packed with the company’s GPUs, sell for $250,000 or more. A new supercomputer that Nvidia brings to market could sell for more than $1 million, Mr. Rasgon said.

“Even though the cost of the system is going up, the return on the dollar is getting better with each generation, so they can keep customers buying,” Mr. Rasgon said.

Wall Street is watching for signs of a slowdown. Microsoft, Meta, Google and Amazon have all developed their own chips that can be used for artificial intelligence, and traditional chip rivals such as Advanced Micro Devices and Intel have tried to break into Nvidia’s business with their own processors AI.

But Mr. Huang thinks it will take time for someone to catch up to Nvidia. The company has been leading the way for a decade and has cultivated a large community of AI developers who prefer its technology.

“We’re fundamentally changing the way computing works and what computers can do,” Mr. Huang said on a conference call with analysts in May. “The next industrial revolution has begun.”