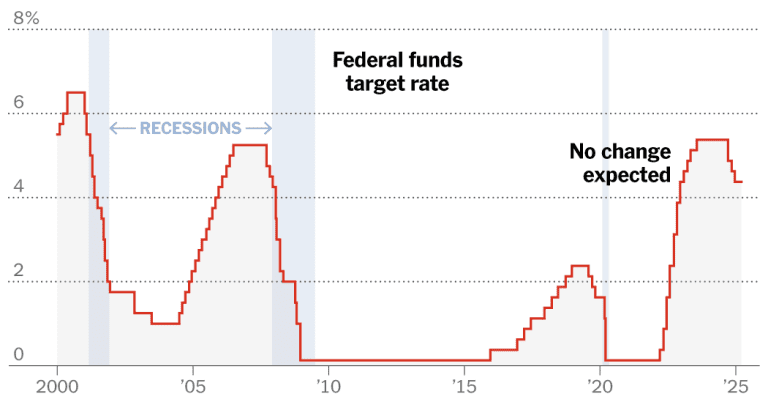

The Federal Reserve is expected to maintain the basic interest rate on Wednesday, after a series of cuts that reduced rates by a full rate last year.

This means that consumers who want to borrow are likely to have to wait a little more for better offers for many loans, but savers will benefit from the most stable savings accounts.

Economists are not waiting for a while another interest rates, as the central bank is expecting more clarity in an increasingly uncertain prospect, as President Trump’s policies about invoices, immigration, extensive federal job cuts, among others.

The Fed reference rate is set at a distance of 4.25 to 4.5 %. In an attempt to collapse the inflation of the sky, the central bank began to rapidly lift the rates-from almost zero to more than 5 percent-between March 2022 and July 2023. Prices have cooled significantly since then and the Fed has revolved to regulate the cuts.

More recently, Mr Trump’s inflation policies could push the Fed to delay more interest rate cuts. But at the same time, the long -term interest rates set by markets have been dragged, affecting a wide range of consumer and business lending costs.

Automatic prices

What is going on now: Car rates have tendencies higher and car prices remain increased, making the affordable challenge. And this is priced before us they threaten to push prices up to even more.

The car loans tend to detect with the performance of the five -year public note, which is affected by the Fed’s main interest rate. But other factors determine how much borrowers pay, including your credit history, the type of vehicle, the loan term and the advance. Lenders also take into account the levels of borrowers who become car loans. As they move higher, the percentages, which makes the loan more difficult for a loan, especially for those who have lower credit ratings.

The average interest rate on new car loans was 7.2 % in February, according to Edmunds, a car purchasing website, from 6.6 % in December and 7.1 % in February 2024. The percentages for used cars were higher: the average loan was 11.3 % in February 10.8 % in February. 11.6 % in February 2024.

Where and how to shop: Once you have set up your budget, proceed to a car loan through a credit union or bank (Capital One and Ally are two of the largest car lenders) to have a reference point to compare the funding available through the dealership if you decide to go this route. Always negotiate the price of the car (including all fees), not monthly payments, which can hide the terms of the loan and what you will pay during the loan life.

Credit cards

What is going on now: The interest rates you pay for any balances you carry were slightly lower after the latest Fed cuts, but reductions have slowed down, experts said. Last week, the average interest rate on credit cards was 20.09 %, according to Bankrate.

Much, however, depends on your credit score and the type of card. Reward cards, for example, often charge interest rates higher than average.

Where and how to shop: Last year, the Financial Consumer Protection Office sent a flame to inform people that the 25 largest credit card publishers had interest rates that were eight to 10 percentage points higher than the smaller banks or credit unions. For the average card holder, which can add up to $ 400 to $ 500 more to interest per year.

Consider looking for a smaller bank or credit union that can offer you a better offer. Many credit associations require you to work or live somewhere in particular to qualify for participation, but some larger credit associations may have more relaxed rules.

Before making a move, call your card’s current publisher and ask them to match the best interest rate you have found on the market you have already selected. And if you carry your rest, you carefully monitor the fees and what your interest rate will go when the introductory period ends.

Mortgages

What is going on now: The interest rates on mortgage loans were volatile. The percentages culminated in about 7.8 % at the end of last year and had reduced only 6.08 % in late September. Solid financial data and concerns about Mr Trump’s potential inflationary agenda have pushed rates a little higher, although they have stabilized in recent weeks.

The rates of mortgages of a fixed interest rate of 30 years do not move parallel to the Fed reference point, but generally monitor the performance of 10 -year government bonds, which are influenced by various factors, including expectations of inflation, actions of the Fed and the way in which investors are reacting.

The average interest rate in a fixed interest rate mortgage was 6.65 % on Thursday, from 6.63 % last week, but below 6.74 % a year ago.

Other home loans are closest to the decisions of the Central Bank. Home shares and mortgages that carry variable interest rates are generally within two billing cycles after a Fed interest rate change.

Where and how to shop: Candidate housing buyers would be wise to get many mortgage interest rates – on the same day as rates range from a mortgage brokers, banks and credit associations.

This should include: the percentage you will pay. Any discount points, which are optional buyers fees can pay to “buy” their interest rate. and other objects such as lender -related charges. Look at the “annual percentage percentage”, which usually includes these elements to get a comparison of apples at your total costs on different loans. Just be sure to ask what is included in APR

Savings Accounts and CD

What is going on now: Everything, from online savings accounts and deposit certificates in the money market chapters tend to move according to Fed policy.

Savings no longer benefit from the most weakening yields, but you can still find returns to 4 % or more online banks. “The Fed, who is getting her foot out of gas with interest rate cuts, means that these odds are likely to stay high for a while, but it will not last forever,” said Matt Schulz, head of consumer funding analyst at Lendingtree, The Online Loan Marketplace.

The yields of traditional commercial banks, meanwhile, have remained anemic throughout this higher rates. The average of national savings was recently 0.6 %, according to Bankrate.

Where and how to shop: Percentages are a thought, but you will also want to consider providers’ history, minimum deposit requirements and any fees (high performance bills do not usually charge fees, but other products, such as money market funds, do). Depositaccounts.com, part of lendingtree, monitors the percentages in thousands of institutions and is a good place to start comparing providers.

Check our colleague Jeff Sommer’s columns for more information on money market money. Crane 100 Money capital, which watches the largest funds on the money market, was 4.14 % from Tuesday, from 5.15 % in February 2024.

Student loans

What is going on now: There are two main types of student loans. Most people first turn to federal loans. Their interest rates are determined for the life of the loan, it is much easier for teenagers to take and their repayment conditions are more generous.

The current rates are 6.53 % for students, 8.08 % for non -subsidized postgraduate students and 9.08 % for loans plus both parents and postgraduate students. Prices are restored on July 1 each year and follow a formula based on the 10 -year auction of public bonds in May.

Private student loans are a little wild card. Students often need co-signal, percentages can be stabilized or changed and it depends very much on your credit score.

Where and how to shop: Many banks and credit associations do not want to relate to student loans, so you will want to shop extensively, including lenders specializing in private student loans.

You will often see ads and sites online that offer interest rates from any lender that can range from about 15 percentage points. As a result, you should give up a fair information before you receive a real price offer.