Investors around the world this week sent President Trump a clear message about his new price policy, he triumphantly announced as a reconstruction of the economic class.

They don’t like it.

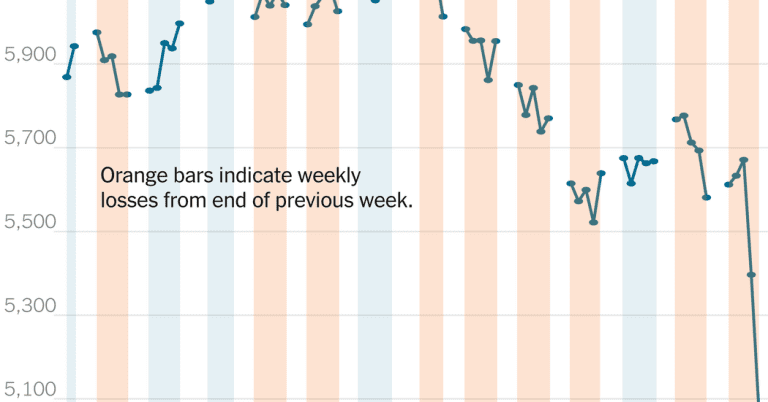

The S&P 500 decreased by 6 % on Friday, bringing its loss to 9.1 % for the week. Stocks had not fallen so quickly since the early days of the Pandemic Coray – it was the steepest weekly fall since March 2020.

Until then, the S&P 500 is quickly approaching the Bear market territory, a 20 % drop from the last high and marks extreme pessimism among investors. By Friday, the index decreased more than 17 % from the top of February. The Nasdaq Composite complex and the smaller companies Index, which are more susceptible to changes in economic perspectives, have already fallen into a bears market. Around the world, stocks have fallen.

But this collapse did not lead from the emergence of a new and deadly virus or an unpredictable housing crisis such as the one that eliminated the values of stocks in 2007 and 2008 as it caused the worst financial crisis from the great recession.

Promoted by a political decision by the President.

“I hope the message that the stock market is sending to the administration is heard,” said Ed Yardeni, a veteran market analyst, in a television interview. “The market gives a big thumb under this pricing policy.”

Analysts and market historians struggled to point out one time that a president had immediately caused so much damage to financial markets. There are some recent parallels: a budget proposal dealing with the British prime minister in 2022 has led to days of market chaos and had to resign within a few weeks.

But Mr Trump showed no interest in support. “My policies will never change,” he wrote in a publication of social media on Friday.

Thus, investors, economists and business leaders hurriedly evaluate the new and unprecedented policies and economic damage that these policies could cause.

“We are just working on what could potentially mean,” said Lindsay Rosner, head of the Multisector of fixed income investment in Goldman Sachs Asset Management. He added that the clean scale of invoices “increases the likelihood of recession”.

It is a remarkable shift in emotion. After Mr Trump was elected and during the first month of his administration, investors were willing to see what a management could in favor of the business that had inherited a healthy economy. They also expect that the president’s impulses for radical economic change could be contained by the market itself – a sudden fall could persuade him to change the course.

Despite the concerns that the stocks were valuable, they continued to climb – culminating in February.

But even before this week’s collapse, EPFR Global figures showed that investors had drawn $ 25 billion out of funds investing in US reserves for two weeks by Wednesday, when Mr Trump announced the tariffs. Since then, JP Morgan has increased its chances of recession over the next 12 months to 60 %, Deutsche Bank has reduced its forecasts for the US economy this year and others across Wall Street have reduced growth expectations and increased inflation forecasts.

Investors have also sharply increased the chances of more interest rate cuts this year, anticipating the Federal Reserve’s need to move on to support the economy. The sale on Wall Street has extinguished $ 5 trillion in the market value from companies in the S&P 500 in just two days, according to Howard Silverblatt, Senior S&P Dow Jones.

As bad the recent fall of the S&P 500, other meters of the market are in worse form. The Russell 2000 has lost a quarter of its value from the top of November. The Nasdaq Composite, which is loaded with technological stocks forged this week, is reduced almost 23 % from the top of December.

“He says this is really bad,” said Liz Ann Sonders, a head investor at Charles Schwab. “This goes beyond anything I saw in one’s worst scenario. This made more to see the animal spirits, which was something that had revived shortly after the election.”

Dan Ivascyn, head of investment official of the PIMCO major asset manager, said the invoice announcement this week represented “a huge change of material in the global trade system” and would lead to “shocking material in the world economy”.

“In recent decades, finances tend to lead political decisions,” he said. “We can enter a period where politics is leading the finances. This is a very different environment to invest.”

Some said Mr Trump himself offered a previous one. In 2018, it imposed invoices on world steel and aluminum imports, solar panels, washing machines and $ 200 billion from China. But these contributions pale compared to what was released on Wednesday, and the impact on markets was much more implicit.

Although Mr Trump has always promised to use the invoices again in an effort to restructure the US economy – bringing the construction back to the country’s borders and making the United States less dependent on foreign trade – the scale of politics and politics fell to investors.

New taxes increased the average effective invoice on US imports at a level not observed since the 1930s, S&P analysts said, the Evaluation Service.

Some investors keep hope that invoices are just a starting point for negotiations that will bring them over time.

However, while Mr Trump suggested that he is open to tariff negotiating with other countries, China has already reacted to the 34 %extra tariffs. Canada quickly introduced invoices and Europe is also expected to respond.

“The base line is so high at this time that even well -negotiating invoices will be high,” said Adam Hetts, a world leader of multinational participation in investors Janus Henderson. He was afraid that the damage had already been done.

“The damage is because invoices now have teeth and the behavior of consumers and the company is already starting to change,” Mr Hets said, also reflecting the fear of other investors – that the duties debate already has frozen business and consumer activity.

Few managers talked about the invoices, but those who expressed alarm.

As the invoices were announced, Gary Friedman, Managing Director of Rh Furniture Retailers, was in a profit call with investors. He heard a curse after checking the price of Rh’s stock. RH takes many of its products from Asia, Mr. Friedman explained.

On Thursday, Sean Connolly, Managing Director of Conagra Brands, told analysts that the food company was trying to keep up with the sudden shifts of pricing policy.

“Things move not only on a weekly or daily basis, but on a hourly basis at the moment,” he said.

From the White House, however, the message is one of the Exuberence – if investors just have the patience to see it.

“Markets are going to grow”, and “the country is about to develop,” Mr Trump said on Thursday. Howard Lutnick, Minister of Commerce, said during an interview on Thursday that “US markets are going to do extremely well, extremely good” in the long run.

The story shows that even the worst crisis on the market will end, when investors are satisfied that prices have been reduced enough to reflect the new reality or another shift in their policy gives themselves a reason to start buying again. On Friday, a March hiring report, which was much stronger than expected, showing that the economy was still on a steady basis last month, failed to prevent market recovery.

Business leaders have responded to surveys saying they intend to slow down plans for their own investment. Executives in airlines, banks, retailers, energy companies and more watched their companies’ valuations decrease this week. Consumers, after trying to go on invoices on some of a long ticket, said they intended to spend less.

“I’m not sure what we have given companies a lot of confidence,” said Ms. Sonders of Charles Schwab. “I think he doesn’t relieve this element of uncertainty.”