How can I get protection from bot risks?

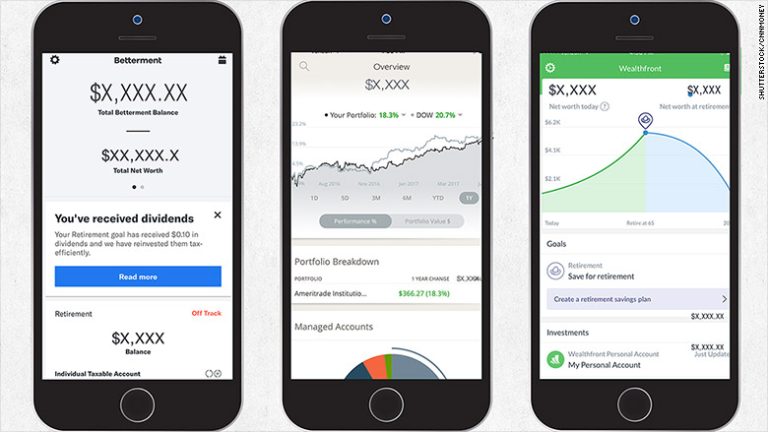

Robo-advisors have remade the investment landscape: they’re simple, low-cost, and passive investing almost always outperforms active investing over the long term.

For most people, the “set-and-forget” mode of passive investing will produce better results than trying to manage your own portfolio — or not investing at all. But while robo-advisors can do well with rules based on modern portfolio theory during a bull market, their algorithms falter during a correction, a bear market, a period of high inflation or greater than usual volatility they may be more demanding.

“Because robo-advisors have a one-size-fits-all approach, downside protection can be limited,” says Mark Struthers, certified financial planner and founder of Sona Financial. “They often use only core bond ETFs as a risk diversifier, which, given the possibility of a bearish equity market coupled with a bearish bond market, may not be enough. Few robos use inflation-sensitive or interest rate-hedged assets.”

Here are some strategies to build some protection against risks, either inside or outside of a robo-advsior platform.

The DIY method

As interest rates rise, investors may want to increase holdings in risk-conscious investments such as fixed-maturity ETFs (traded funds), individual bonds, individual TIPs (Treasury Inflation-Protected Securities), or mutual funds and ETFs that related to TIP to act as a differentiator, Struthers suggests.

“When you talk about risk, it gets personal, especially as you get older,” says Struthers. He says he often sees Robos using vehicles like LQD, EMB and AGG (Corporate, Emerging Markets and Aggregate Bond ETFs, respectively) from iShares. “These are all good core bond funds, but they may not be enough of a risk diversifier.”

He says he appreciates Dimensional Fund Advisors’ approach to core bonds because it aims to outperform traditional index funds and avoid stock picking and market timing.

“I know that if there’s a market dislocation, they have the ability to ride it out,” says Struthers. “They don’t have to sell because the index says so. If you can find a core that has low cost and some common sense risk diversification, so much the better.”

Another alternative is the Swan Defined Risk Fund, an ETF that helps investors who struggle to stick to a buy-and-hold plan during headwinds and who want positive returns while minimizing downside exposure to equity markets, according to with Sean Gillespie. , registered investment advisor and co-founder of Redeployment Wealth Strategies. “You can have this protection built in: always fully invested and always fully hedged.”

Inside Robo-Advisors

Some investment advisors say downside protection is antithetical to the Robo model. “I don’t think you’re getting disadvantageous protection from a robo-advisor,” said Thomas J. Duffy, a certified financial planner at Jersey Shore Financial Advisors. “Robo-advisors have ended up providing an investment experience at a deep discount to what the investment management institution has offered,” he says. So you essentially get what you pay for when it comes to risk protection.

However, some, such as Wealthfront, offer services within the platform (for an additional cost) to increase risk-adjusted returns in various market environments through an enhanced asset allocation strategy called risk par.

“We’re always on the lookout for academically proven, rules-based passive investment strategies,” says Andy Rachleff, co-founder and CEO of Wealthfront, a robo-advisor with $11 billion in assets under management.

Risk parity was popularized by Bridgewater Associates, the hedge fund juggernaut, and offered in the 1990s for its institutional investors as an “all-weather fund.” It is based on research that has shown that certain types of exposure to low-volatility stocks could outperform investments in high-volatility stocks.

Wealthfront has brought this more sophisticated allocation strategy, once reserved only for the wealthiest, to a wider range of investors. Those with $100,000 in taxable assets can benefit from risk parity investing. The expense ratio for the risk parity fund is 0.25%, which has halved from the initial cost of 0.50% when it launched earlier this year.

Of course, one of the healthiest hedging risks when using robo-advisors is reliably old-fashioned and low-tech: an emergency fund.

“If someone is using a robot and is concerned about risk, I would make sure you have a big emergency fund,” says Struthers. “Then we hope they overcome any negative flaw of the robos.”

CNNMoney (New York) First published September 20, 2018: 1:26 pm ET