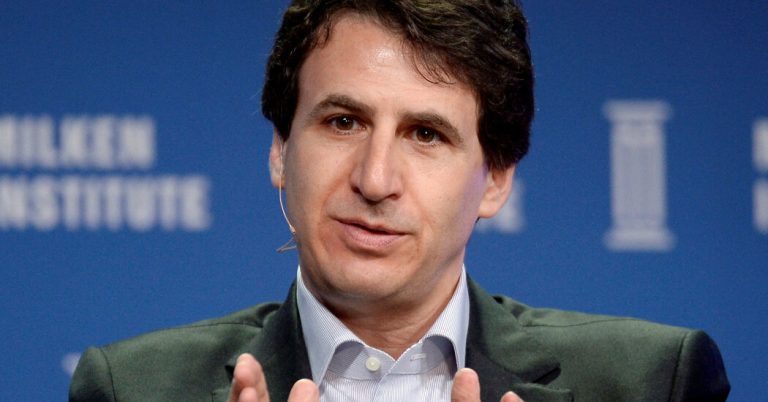

I spoke with Marc Rowan, CEO of Apollo Global Management, about a provocative plan that believes it could fundamentally reshape our economy and ultimately determine the federal budget. Whether it has the opportunity to apply is an open question, but Rowan’s links with President Trump and the Chatter the plan creates that it could affect budget talks later this year.

Several weeks after the distance of President Trump’s elections, he called Marc Rowan, co-founder and chief executive of Apollo Group, Giant Private Equity and Credit Firm, to Mar-A-Lago for an interview with a secretary of the Ministry of Finance. Rowan, who was in Asia for a meeting with investors at the time, canceled all his plans and threw around the world to meet Trump. Rowan, who is undoubtedly one of the strongest funders in the world, spoke with Trump, but eventually didn’t get the job done. (Scott Bessent.)

But since then there has been an increasingly influential voice on economic policy on President Trump’s orbit and even among some Democrats – and has placed a very specific plan.

Rowan, Managing Director of Apollo, is the champion of a budget for the federal government to help fund at Wharton school at the University of Pennsylvania President of the School Council. It is called the “Penn Wharton budget model”, includes reduction in taxes, but also cutting almost any tax exemption. Increasing the tax rate tax rate; carbon tax creation and re -registration of immigration and healthcare rules. His proposals – which according to the model could by 2054 create a 38 % reduction in federal debt, 21 % increase in GDP and 7 % wage increase – are likely to draw both boos and applause both from Republicans and by the Democrats.

You will probably hear a lot more about the idea as critical budget talks that are approaching this summer. With federal debt entering a level of record that worries Republicans and progressive economists, no sudden interest rates fall, and the president has expanded tax cuts that will increase the deficit to $ 3.7 trillion in the next 10 years With the Congress Budget Office, policy -makers are shopping for non -contractual solutions.

I sat with Rowan recently to discuss the plan and how it happened. The interview has been edited and concentrated.

What inspired you to start considering these issues in this way?

In 2008, I watched Obama’s administration to rewrite the entire US economy – restructure airlines, cars, finances, insurance. And they were hostile to the industry. I took the phone and called the then president of the University of Pennsylvania, Amy Gutmann. I told her that I would build a focus on you, economically focused, focused on budget entity, if you support it. And that was the birth of the Penn Wharton budget model.

Why are you interested in creating the model?

There is no budget standard for the country. It’s like 28 Excel spreadsheets. And if you bring coffee and donuts in the morning, you get a better score than if you didn’t. If you are the chairman of the committee or you are a senator and want to negotiate an account, you cannot score your account until later. Imagine you are making a redemption, but you can’t run the numbers until you agree to buy it! This is how our government is running.

Given the current budgetary situation – the US is expected to record one Budget of 1.9 trillion $ This financial year – how much do you think our financial challenges are actually?

There is no formation of tax cuts and cuts in the costs and changes of the current package and salt that will result in anything meaningful, because we’ve been waiting for a long time. But that doesn’t mean it’s not possible.

What exactly would you do?

So what did Trump promise? Has promised low tax rates. I can get him low tax rates, 28 %. Has promised a lower corporate price. I can get him 15 percent corporate interest rate. He has promised to balance the budget and fiscal prudence without making a bundle of things that reach the rights. I can do that too. This budget gives it an alternative. There is not a single cut in this budget. If they take cuts and work and do many other things, that’s all upward.

This is remarkable if it is true. Let’s take the details. You are talking about reducing the top tax rate and exemption from discounts at a time when many people believe that the richest pay very little.

A low marginal rate allows you to remove many distortions. At the point the top marginal tax rate becomes 27 % [down from 37 percent]The salt discount is not worth it so much. Capital wins a difference, it’s not worth it so much. Tax planning and trust and tricks around real estate programming is not much worth it. And what you are starting to do is underestimate all these games and start underestimating the whole concept of differences between S-Corps and companies and other things. And the simplification that it does not have people to focus on discounts is overwhelmingly positive. The people I have generally run what they pay for capital profits and do these things are like, “Okay, register me.”

You are also talking about reducing the corporate interest rate to 15 %.

We have 21 % corporate interest rate. But the effective rate is 13.6. So we continue taxes based on something close to 15, but we encourage companies to make decisions from 21. Suddenly everyone will make the marginal decision at 15 and we will not collect more or less money. We change the behavior.

What gets you from 21 to 13.6 is a series of distortions-the Christmas tree of the ornaments: Pharmaceutical Deletions, R&D credits, all distortions that get from 21 to 13.6. Once you go to 15, why are you going to Ireland or Bermuda? At this point, all the incentives to move income around the world through this shell game also disappear.

Do you effectively argue that a 15 % tax rate is actually even higher than today is the average?

Yes. You face growth on the sidelines. You face people who work the most because the next dollar will keep more. This is what you want. It’s an incentive. And reward companies to record more of their income in the US, because the limit rate will be taxed at 15 and not 21.

The progressive side would say that taxes should be even more progressive than they are. People at the high end of income layers, as you are at an even higher end than they were ever. And therefore, they would say, we have to think about how to tax this team in a different way, given the branching of income these days.

Look, this has been tested everywhere in the world. He has not worked. Everyone who has tested it has basically resigned. New York steals its tax base. California looked at its tax base. It just doesn’t work, because the richest in the world are fundamentally the most flexible in terms of what they are ready to do to move. We are, as you know, the most progressive western country when it comes to a tax code. The rate of tax paid by the rich for this proposal and for people like me, my taxes go up on the first day.

Will you pay more below it?

I pay more than that than I do otherwise.

You can get rid of the “death standings”, a layout that deletes capital profits in a deceased portfolio and appreciates everything on the date of death, which most Republicans would not want.

I like to allow a generation of entrepreneurs to build wealth and maintain their wealth and keep more than that. But when they die, they do not transfer it to tax free. This seems incredibly American.

I think if you grow up your wealth and still work, you will like this plan because although you will pay more today, everything you go forward will keep more than that until you die.

But don’t everyone do?

On the other hand, if you are the rich rich, you will not like this plan because you will pay more today for capital profits. I don’t think it’s a bad result.

The model includes this idea to require illegal immigrants to pay for health insurance. How would this work and what is the impact?

We will end up in a huge part of the population revealed by health insurance due to cost. With this plan, we end up with almost universal health coverage.

How yes?

Premiums are coming down because you add this huge requirement for new immigrants to be in the healthcare team, which takes the premiums for almost one third.

So are you not the expulsion of all illegal immigrants?

What I’m talking about is smart deportations. Get rid of the people you need to get rid of it because it’s a danger to society. Recognize that you have a lot of people here who are here for financial reasons, serving valid functions, but don’t let them go to the economy.

But will not the cost of insurance to be transferred to the employer and therefore the consumer?

For those industries that have benefited from illegal immigration, this will impose costs on these industries because there will be some growth costs between the immigrant and business.

What kind of reaction have you reached all this?

I never expected this. The interest I get out of the charts and is not one of the Republicans or the Democrats, because depending on the glasses you use, this could be a truly democratic bill – lower marginal tax rates, do you know, lower corporate tax rates? Or it could be a truly democratic bill, which is not a tax breaks, no benefit from death, right? Requirement for health insurance. It allows people to see it with their own view of what they are.

Honestly, how realistic do you think all this is?

Washington, left on its own devices, will do absolutely nothing more than the status quo. They will inflate and Jive and the budget trick and will achieve nothing. And the deficit will continue to rise. Only if they receive a quantity of push for the market or become politically impossible to cross a status quo budget will they consider an alternative.

Thanks for reading! We’ll see you on Monday.

We would like your comments. Please email thoughts and suggestions to dealbook@nytimes.com.